About Harm

As a tax specialist, Harm focuses on the future. Harm assists sellers and buyers in acquisition processes. Here, topics such as an appropriate exit strategy, acquisition considerations, and corporate structure are addressed. It is essential for a business to be well-prepared from a tax perspective for a future business transfer, acquisition, or succession.

Harm also has extensive experience in conducting tax Due Diligence processes, both for buyers and sellers, ensuring the correct tax provisions, indemnities, and warranties are included in purchase/sale agreements. Additionally, Harm advises on the establishment of employee and management participation schemes and on business transfers within families, specifically in relation to the tax-efficient ‘bedrijfsopvolgingsregeling’ (BOR).

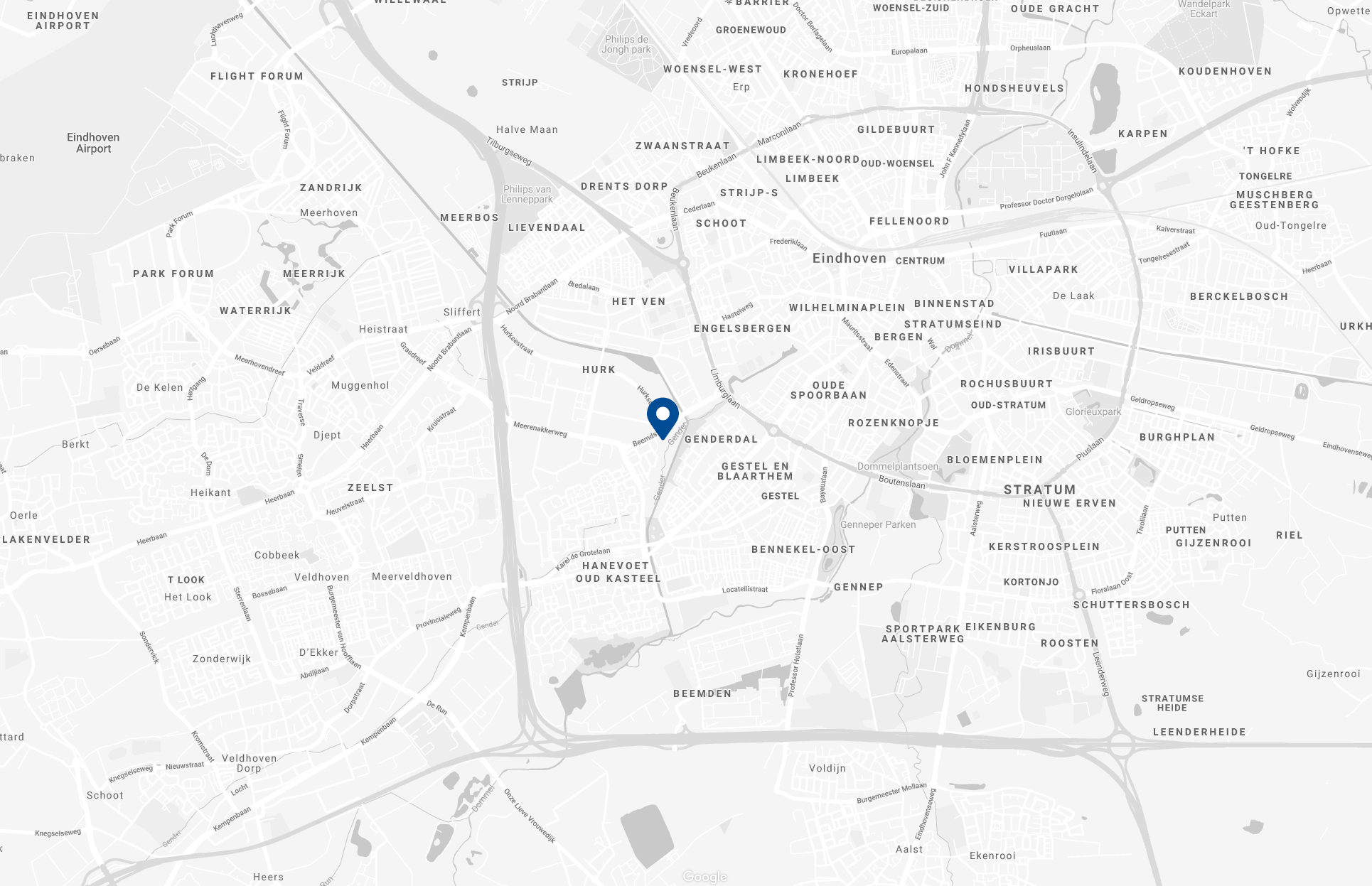

Since 2015, Harm has been a tax partner at Govers Accountants & Adviseurs and works closely with De Beemd Corporate Finance.